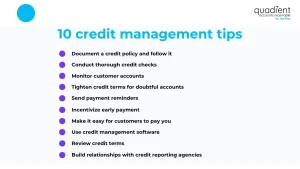

Here are some tips for businesses to improve their management of credit

Credit management is integral to businesses. It enables them to extend credit to their customers while minimizing the risk of bad debt and financial losses. Effective credit management involves implementing strategies to assess creditworthiness, establish credit policies, and manage collections and payments. In this article, we’ll share tips for businesses to manage credit effectively. By following these tips, businesses can reduce credit risk, improve cash flow, and build strong relationships with their customers.

Credit management is the backbone of any business that extends credit to its customers. It involves a set of processes and strategies that help control the flow of credit. From assessing a customer’s creditworthiness to setting limits, establishing payment terms, and monitoring customer accounts.

By keeping a sharp eye on credit management, businesses can steer clear of the dreaded non-payment or bad debt, which can take a heavy toll on cash flow and profitability. In addition to maintaining positive relationships with customers, effective credit management practices can improve a business’s cash flow, reduce bad debt, and drive growth.

Credit management encompasses an array of activities, such as conducting thorough credit checks to assess customer creditworthiness, setting realistic credit limits and payment terms, following up on late payments, implementing collection strategies for overdue accounts, and keeping tabs on credit trends to make necessary policy adjustments.

Businesses that stay on top of credit management can work with credit reporting agencies to stay in the know about changes in customer creditworthiness and leverage that knowledge to make sound decisions about extending credit.

Ultimately, effective credit management is the foundation of a thriving business, enabling it to operate with the necessary cash flow to expand, innovate, and remain competitive.

- Document a credit policy and follow it: A credit policy should clearly outline your business’s credit terms, including credit limits, payment terms, and consequences for late or missed payments. Make sure to document your credit policy and that your AR staff follows it.

- Conduct thorough credit checks: Prior to extending credit to a new customer, conduct a thorough credit check to evaluate their creditworthiness. This will help you determine the amount of credit to extend and the terms of repayment.

- Monitor customer accounts: Regularly monitor customer accounts to ensure that they are meeting their payment obligations. Immediately follow up on late payments and ensure that the consequences of non-payment are clearly communicated.

- Tighten credit terms for doubtful accounts: A doubtful account is an account receivable that might become a bad debt at some point in the future. Consider tightening credit terms for these customers.

- Send payment reminders: Reminding customers of invoice due dates in a professional, friendly, and timely way helps encourage on-time payments. You can use automated communications to send friendly “upcoming payment due” notices, as well as past due reminders. These notifications can be delivered via email or text.

- Incentivize early payment: Consider offering discounts or other incentives to customers who pay their bills early. This can encourage customers to pay on time and reduce the risk of bad debt.

- Make it easy for customers to pay you: Make it easy for customers to pay you and offer them as many payment options as possible. Consider providing an online portal so that customers aren’t limited by your business hours or the post office pickup. Give your customers the opportunity to make payments directly from an online invoice.

- Use credit management software: Credit management software can help you mitigate credit risk and automate credit decisioning.

- Review credit terms: Regularly review your credit terms to ensure that they are still appropriate for your business and that they reflect current market conditions.

- Build relationships with credit reporting agencies: Establish relationships with credit reporting agencies (Equifax, TransUnion, and Experian) to stay informed about changes in your customer’s creditworthiness and adjust your credit policies accordingly.

By implementing these tips, businesses can improve their management of credit and reduce the risk of bad debt.